Most companies that create antifraud solutions for online business do not disclose their methods and technologies of high risk patterns and behaviour markers identification. We at JuicyScore have different point of view and reveal some interesting details about the antifraud technologies to our partners and clients apart from the tools for fighting fraud. This helps us to add some transparency to the ways we identify high-risk segments in application flow, shreds light on the operation principles of the markers and attributes presented in our new API 13 and also increases customers' confidence. New API 13 was enriched with the wide range of new risk-markers and today we are going to give you some interesting details about them.

What are the main challenges of making a new product?

One of the main challenges when making a new product, especially when we speak about such a significant thing as development of new API generation, is verification of the most dangerous and risky markers and patterns that incur direct losses for the financial institutions. Search and implementation of such markers lets to decrease financial losses significantly: for example, it will protect the company from issuing a loan to an unreliable client and also will allow to reduce operational costs during the verification of presumably fraudulent application.

What are the main threats we help to deal with?

One of the most dangerous patterns which, actually, can be commonly found in online lending is applying from the device with randomizing effects. So, first of all, the main difficulty related to such devices is that it is impossible to verify whether this device has already been used for submitting an application (and if this client has already applied for a loan). Therefore, it is really difficult to assess the history of his behavior in the past. Secondly, the fact that there are a lot of randomization technologies on the device gives us the reason to presume that we are dealing with an unusual client who has rather high technical qualification and for some reason does not want to disclose information about himself, and, therefore, carries an increased risk for the company.

API 13 new risk markers

One of the new markers that has been added to the vector of JuicyScore API 13 is the operating system font randomization marker, which provides information about how many manipulations a borrower performed with the operating system parameters before applying for a financial service. In this case we are not talking about basic settings and customization for a specific device user, we mean much more complicated technical settings that require special skills and qualification - outrageous cases when settings and parameters are very different from the standard ones, and the "customization" of such settings extremely exceeds the limits conceivable for an ordinary user who intends to apply for a payday loan. According to our statistics, the share of such devices in the flow usually does not exceed 1% with potential peaks at the moment of activities of potential high-risk borrowers.

In addition to the settings of the device itself, which can be manipulated by the defaulters, the analysis of applications installed on the applicant's device is also an important part of the risk assessment. The set of applications, their categories and number is an important behavioral marker and such parameters have already been presented in our API earlier. However, in the new version of API we added a technology stack to detect manipulations with installed applications - it is one thing when the official application was installed from an authorized marketplace, bun an entirely different thing when an installed application undergoes changes and modifications and becomes a completely different application. In this case, there is a risk that the borrower applies for a credit with malign intent.

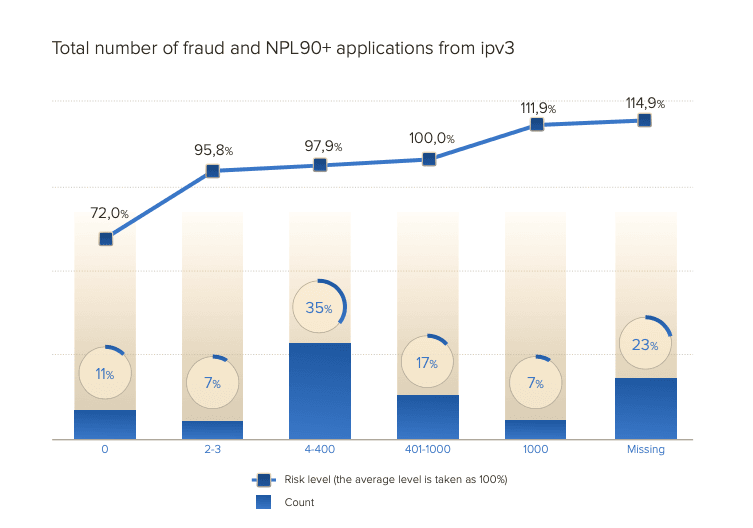

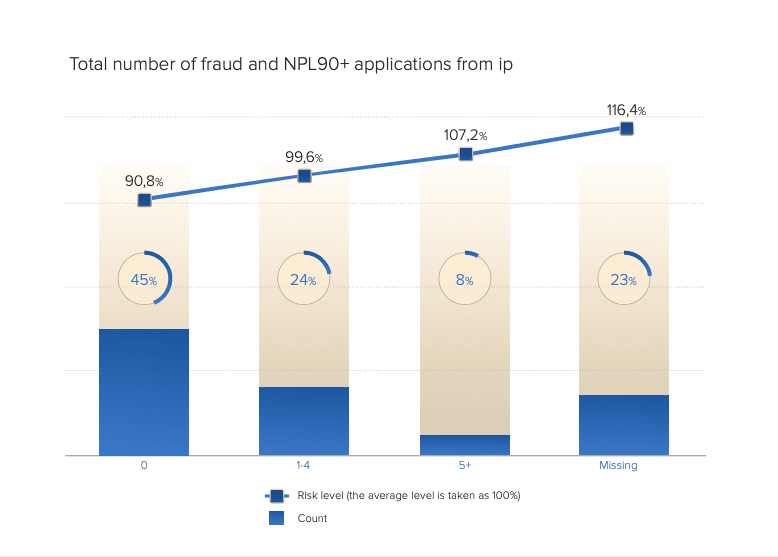

Another important parameter for risk assessment is different frequency responses, for example, the number of risky applications from the same device or IP address, for a limited period of time or simply for the entire observation period. Usually the risk increases with the frequency increase, since this may indicate both - the risk of credit shopping or risk of fraud, especially if such activity is supplemented by manipulation with other data. In JuicyScore APIv13 we have expanded this group of parameters - now, in addition to the fact of application, we will also be able to provide our clients with the information about the various types of web resources the borrower visited in the last 24 hours before applying for a loan. Such metric will allow us to make applicants' risk assessment more accurate as well as indirectly determine his credit profile.

The markers we discussed in this article are just a small part of the expansion of information value that we proposed in JuicyScore APIv13. We understand how important it is to expand the set of markers and stop factors that help to save the expenses and reduce losses from the risk of fraud - our team is constantly working on the technology development in order to provide our partners and customers with the tools to outplay suspicious and high-risk clients and to resist the fraudulent activities.