The past decade has seen a series of technological breakthroughs which opened many opportunities for the fintech industry and took it to new heights. The Covid-19 pandemic has had a significant impact on the financial sector and fintech is no exception. The crisis forced players to improve efficiency rapidly, optimize costs and implement new solutions. Based on the latest research and expert observations, we are going to tell you how the fintech market reacted to the pandemic in different regions, how it affected the risks and what trends will determine its development in 2021.

Challenges 2020

The year 2020 gone by and speeded up the processes that many companies were trying to implement before and also shed light on some new problems.

Going online

The process of active digital transformation has become the main growth driver for many companies. For the financial sector it has become obvious that moving online a significant part of business processes is inevitable and now is an essential condition for the development and maintenance of any company's position in the market, as well as for obtaining new business in the future. Fintech industry leaders now are and have always been online early on and have all the necessary infrastructure and technology stack, so today they have an additional advantage over traditional financial institutions, which had to restructure their work root and branch. For example, JPMorgan Chase, the largest bank holding company in the United States ranked by total assets decided to expand its presence in the UK, but instead of opening branches the bank offers services only via a mobile application.

According to the McKinsey study, which covers 30 countries and 86% of the population, about 40% of respondents choose online channels much more often when using financial services, about the same percentage of respondents said that they would not return to their previous habits and would use financial services online in the future, despite the end of strict measures connected with the lockdown.

Global investment runs deep

Amount of investment in developing markets has decreased compared to previous years, however it should be noted that the main fall occured at the peak of the pandemic - the end of Q1 2020, when the volume of investments fell to the level of 2017 . Total volume of merges fell 24% in Q3 compared to the same quarter in 2019. However, amount of investment in Q3 rose to 10.631 billion USD. It has become the most significant result in 2020 and the second-best quarterly indicator since mid-2018. According to CB Insights, the problem of reducing number of transactions mainly affected startups, since traditional financial institutions that used to work with startups earlier are now creating internal development departments and working on their own financial solutions. Experts suggest that under the new conditions startups and small tech companies, which have been the growth engine of fintech development in recent years, nowadays may have some difficulties in attracting new investments.

New regulatory requirements

Fintech uses a wide stack of technologies to support and develop online business, designed to speed up the interaction with a client, making payments and conducting other financial transactions. At the same time the importance of privacy and data protection is growing immensely. As a way to compete successfully with traditional financial institutions it is necessary to take into account all changes in legal regulation, particularly regarding the requirements for the processing of personal data. Increasing regulation in 2020 in various regions is one of the factors that experts note among a number of reasons that negatively affect market growth. For example, regulations similar to the General Data Protection Regulation (GDPR). This problem also affected Asia, at the end of 2020, an analogue of the GDPR appeared in China - Personal Information Protection Law, applicable to foreign legal entities and individuals who process personal data and provide services to entities located in China.

In addition to government regulation, it is necessary to take into account the policies of technology companies and bigtechs regarding the software they produce: browsers and operating systems in respect of collecting and processing user data. Failure to comply with these requirements can lead to a situation when certain mobile applications and websites of fintech companies may be blocked.

Data storage and processing security

Due to the pandemic a large number of users switched to the online channel as a main source of obtaining financial services. In fact, online channels allow companies to reduce operating costs significantly, as well as to gain access to a wider audience on the one hand, and not to risk with one's health speaking about the clients on the other hand. However, today we are witnessing a really big leakage of personal data day by day and when it comes to the Internet it leads to increasing number of cyber attacks globally. That is why the secure storage of user data is becoming one of the most important issues in today's online business.

According to Security Intelligence, the average cost of data losses in 2019 amounted to 3.92 million USD. Leakage of customer-sensitive data such as payment card numbers, passwords, financial transaction data, passport data and other personal documents can lead to a complete loss of customer's trust. Users want to see the transparency of their operations as one of the criteria of high-quality services provided. The year 2020 has shown that fintech companies need solutions that combine both factors - transparency and security - more than ever. The best solution is a reasonable reduction in the turnover of personal data and direct user identifiers, combined with the use of alternative sources of information, such as device data, Internet connection data and user behavior.

Credit risks and business pivot

A smooth sea never made a skillful sailor, so in 2020 those players who understood the importance of maintaining balance between reduction of credit risks and the speed of adjustment and creation of new business models turned out to be the most successful. Financial institutions that concentrated all their efforts on a quick solution of the problem, in particular, companies that focused on changing risk-based pricing, setting new limits etc., as well as those who continued to work hard and did not suspend most of their work processes during quarantine, managed to successfully return to normal rhythm in Fall 2020 and essentially won the market. The time has shown that companies that did not cope with quick adaptation reduced traffic volume, lost citation in context and faced other problems that affected the rather painful process of returning to the usual schedule.

Trends 2021

Formation of new ecosystems

The new formats of fintech market eco-systems turned out to be more competitive in a number of countries in comparison to the captive/internal eco-systems of corporate giants due to a higher development speed, better coverage and greater flexibility/adjusting to the specific needs of the client, as well as the development of partnerships with other companies. Moreover, in 2020 we noticed that small companies left larger companies behind speaking about the speed of development and implementation of new technologies. Forming a proper ecosystem around them they will be able to compete with such giants as Apple or Google. One of the most successful fintech startup examples according to Forbes is the MoneyLion neobank. Its application lets not only to open a new account or check it up, receive services related to cards, the company also offers an innovative automated solution for managing ETF investments.

Big Data

According to statista.com, the global Big Data market will reach 103 billion USD by 2027 and will double compared to 2018. Financial companies try to collect as much information about the client as possible in order to meet the demands of the customer and to personalize offers and increase customer loyalty by analyzing the data. Big Data allows you to make your business more client-focused and achieve better results. Fintech companies can focus on customers' segmentation, receive real-time information about users, optimize pricing policy and predict which services may interest the customers in the future.

However, the more data you get, the more difficult it is to manage it effectively ensuring the security of customer information from third parties at the same time. Over the past ten years financial industry has invested heavily in data collection and processing technologies: data warehouses, analysis tools, data visualization tools, forecasts based on current information. According to experts, fintech companies will actively continue working on this in 2021, since user expectations have changed quite dramatically. More difficult conditions have led to a greater competition and therefore the companies must process all the data quickly and efficiently keeping in mind that today security really matters.

According to Oracle, financial institutions that offer more personalized financial services to their clients raise their income 18% per year. According to use case of one of the branches of American Express Bank, it created a complex forecasting models using Big data technologies that helped to prevent customer outflow: based on the analysis of previous client transactions, the bank was able to determine which accounts were likely to be closed over the next few months. This may help to take necessary measures and reduce customer churn.

Cybersecurity

Cyberattacks lead to rather harsh consequences and loss of reputation of any financial company. Problems arise due to many reasons, the main of them is cooperation with third-party organizations, extensive use of mobile technologies and online data transfer, the natural growth of hacker attacks. Cybersecurity Ventures estimates that cybercrime-related damage reached 6 trillion USD a year by 2021.

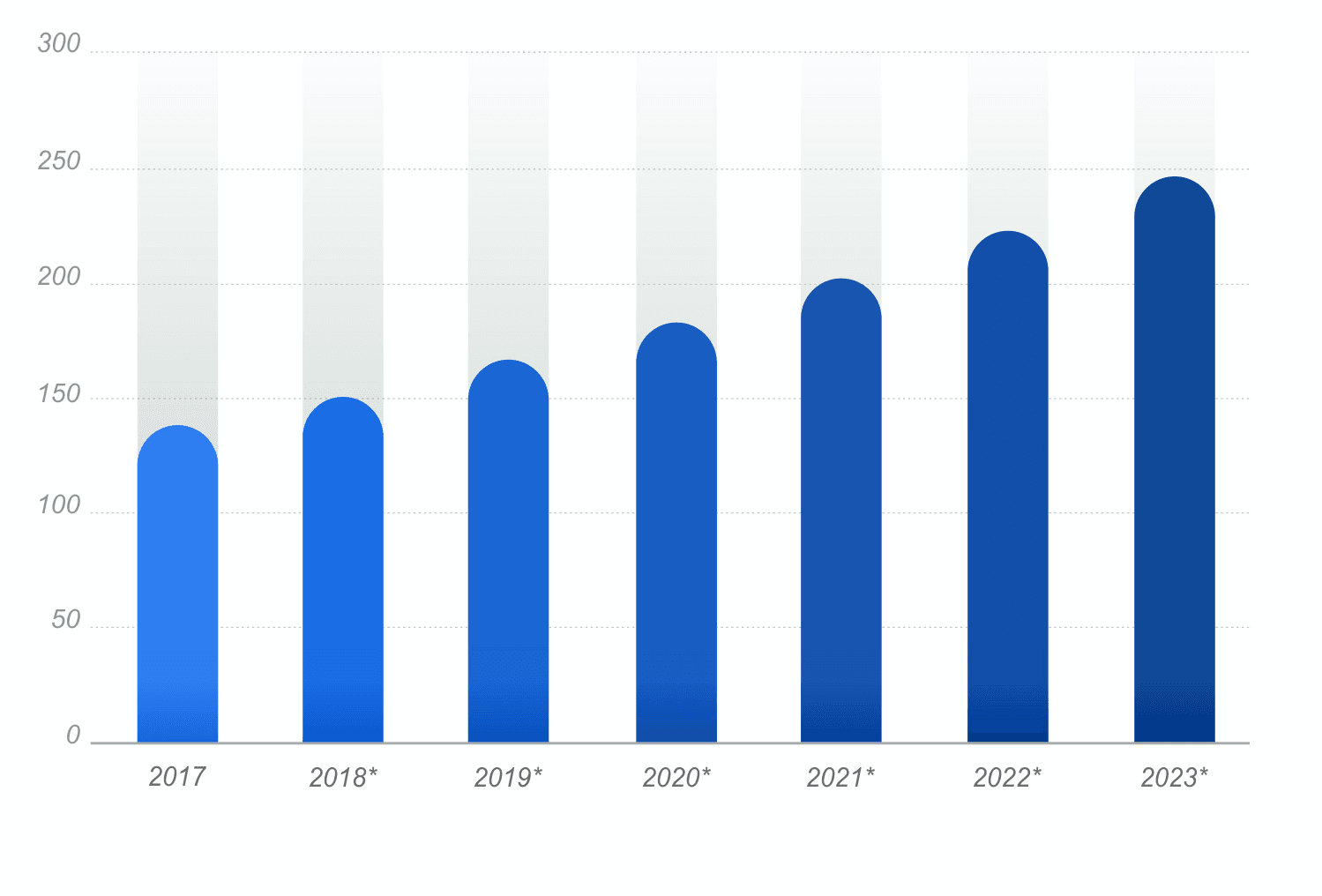

Size of the cybersecurity market worldwide, from 2017 to 2023 (in billion U.S. dollars). Source: Statista.com

Among the focus areas of cybersecurity work for fintech companies experts pointed out the following ones:

- Security of transactions, risk management technologies.

- Technologies of secure storage and exchange of data, including personal data protection.

- Remote authentication technologies and biometric solutions.

New conditions - new opportunities

The main thing the last year showed in the context of the fintech industry - the challenges of 2020 increased the speed of change in a number of areas and set a new bar for business efficiency as a result of investment decline.

The second thing that is also really important to note: Fintech leaders showed really strong competitive advantages compared to traditional financial institutions. For example, the revenue of the fintech sector fell by 10-20% at the peak of the crisis, while the bank losses were several times higher - 40-70%. Large banks that received funding in 2020 could not oppose anything to fintech, except for the growth of mortgage.

Third, along with the difficulties the pandemic has brought new opportunities. The pandemic marked the final step for many companies to go online as well as brought the era of full digitalization, which gives the chance to fintech to significantly increase market share.

The fourth important conclusion is that the speed of new technologies implementation is becoming one of the main factors of market success. Organizational set-up of fintech companies and their data providing and processing policy have to meet these requirements.

This year Juicy Team will continue to maintain a high pace of development and delight our customers and partners with new product functionality, for you can ensure high competitiveness and business safety only through efficient and hard work in a dynamic digital world.