For many years we have been working really hard to ensure our products bring maximum benefit in terms of borrowers evaluation and risk assessment. In many financial institutions, micro lending companies as well as the companies, which are not related to financial sector, significant part of business is offline. Estimation of such potential clients is related to a number of difficulties - lack of data, “thin” customer credit profile etc. Until now it was not possible to conduct a risk assessment through the device for such clients. And today we present a new solution we have developed: an offline to online transition tool, which helps to assess the risk of an offline applicant and build their digital profile without significantly affecting the conversion rate.

The purpose of creating JS App - Device Risk Analytics is to provide customer device scoring as a service for offline businesses, including customer assessment supplement via conventional offline sources. The product will also be useful for companies that do not have their own IT infrastructure, as well as for online businesses creating an MVP and would like to save money on launching it.

What industries JS App - Device Risk Analytics - is designed for?

Solution may be effectively used in any business with offline offices, branches or stores and where potential client underwriting or risk assessment are required.

In order to get a better understanding in what industries JS App - Device Risk Analytics can be applied, we would like to demonstrate a few use cases, when a person who is rather subtle in financial issues would rather use an offline channel in order to obtain a financial product.

Let’s imagine a situation when a person enters the bank or micro lender’s office, which is located not far from home or office in order to open an account, a card or to get a loan - we can’t but agree that this is rather usual scenario, because many people are comfortable talking to a real person, who can help to solve all the issues at once (such situation also may occur, speaking about certain categories of borrowers, for example, elder people).

Another example refers to a point of sale, where a consumer purchases and pays for goods and services or any offline store, telecom or electronics store. Such people initially do not have the goal of obtaining a financial product, but may decise to buy something if a POS loan, credit card or any BNPL product are available. This also may be a person who wants to buy a car or to get an insurance certificate.

In all the above use cases, service provider collects a potential client's data, does verification and underwriting, using device risk assessment only as a part of verification process. But we believe that device data and a strong digital profile can play more important role and give much more value in a decision making process.

First of all the product will help greatly in risk assessment of clients with the so-called “thin” credit history, for example, young people, retired people, residents of remote settlements, citizens of other countries as well as those who have never used credit services. Depending on the country, the proportion of such citizens can start from 30%.

In many cases device information available for risk assessment through our JS App - Device Risk Analytics solution will have a significant impact both on the approval rate (starting from 10% of relative growth) and expected Gini increase (assuming that in markets with a developed credit bureaus structures, share of credit history effect is about 50-75%, and the lack or absence of digital profile data can strengthen the decision-making model by dozens of percents in relative terms and by 5-15% Gini in absolute terms).

UX for JS App - Device Risk Analytics user

In order to start a borrower should download our application either from Apple Store or Google Play - it is available for iOS and Android (soon will be available on Huawei AppGallery).

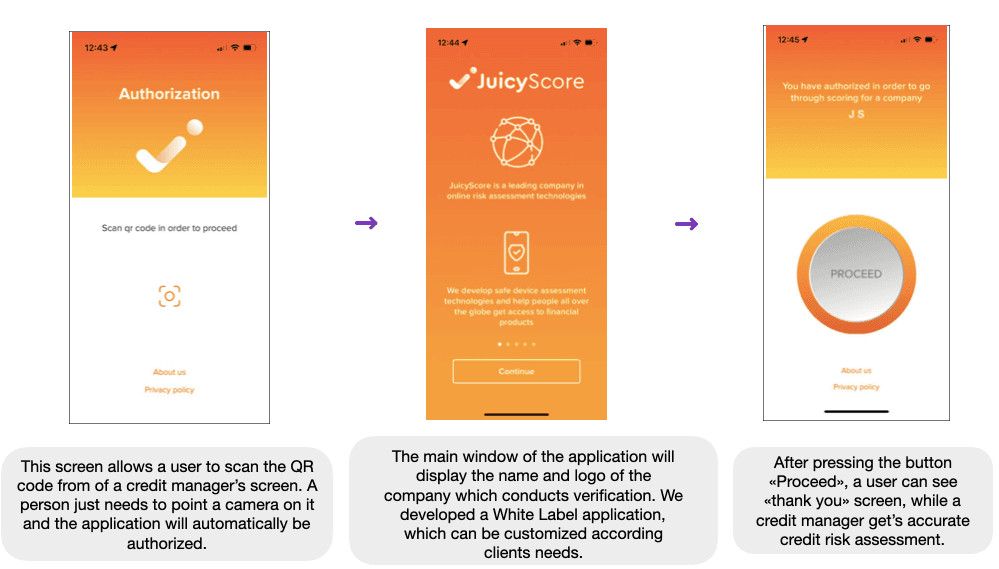

When the application is downloaded a client is able to become familiar with security and data processing policy, grant access to camera (only when using an app) in order to scan a qr code and granting access to geolocation. At the same time a client can see the logo of the financial company were he is applying for a financial service, since the JS App - Device Risk Analytics is a white label (some sort of partnership when a company can provide a service to its customers on behalf of its brand using its partner company's product).

JS App - what it contains?

JS App - Device Risk Analytics solution consists of:

- Mobile application for iOS/Android - both in the format of ready-for-download application from the marketplace as well as in SDK format for embedding into the native application of a financial institution;

- A ready-made module for generating a qr-code and viewing the results - the qr-code will be tied to a specific financial institution and a specific client application.

JS App - Device Risk Analytics solution advantages

Risk assessment significant improvement (especially in cases where there are not enough classical sources - credit bureau data or a profile data). With JS App - Device Risk Analytic_s_ it becomes much easier to build a complete digital profile for each client, and not just for those who come to the online channel;

The ability to set up communication with customers more accurately by analyzing those who have previously visited the site, linking the entire set of devices to each client profile;

No need to create your own infrastructure for device evaluation and fingerprinting - JuicyScore provides a turnkey solution + support and regular (monthly) product updates;

Ease of integration:

Device risk assessment is seamless for the client (the process takes no more than 30 seconds), practically does not affect the conversion and at the same time significantly improves the quality of the decision made on the side of the financial institution;

While most of similar solutions use personal data, our JS App - Device Risk Analytics solution does not request access to personal data, passport or other identity documents.