We always pay attention to the details related to the business of our clients and also try to keep abreast of the latest trends in the data market to make our products even more valuable. In addition, we always keep in mind the important conditions that must be taken into consideration working with the big variety of data. In this November we conducted a customer survey and asked our clients to express their opinion on various data sources they use in decision-making system, which particular sources they choose and also asked them to share their business experience and thoughts about data regulation. A few interesting conclusions emerged during analysis of our survey's summary results: in what way lenders around the world approach the choice of data sources for making their credit decisions for new applications? Now we are going to tell you about the prospects of the development of the data market in the nearest future.

Most usable data sources: know your trend

It is essential to mention that our clients’ business is located in 14 countries, including Russia, Kazakhstan, a number of European countries, different countries in Middle East, Southern Asia and South-East Asia, so the information that we collected is unique and rather valuable and reflects the real picture of the present markets. We were aimed to verify most common approaches to data sources valuation as well as to develop important guidelines which are true to all the markets.

The main trends of Survey

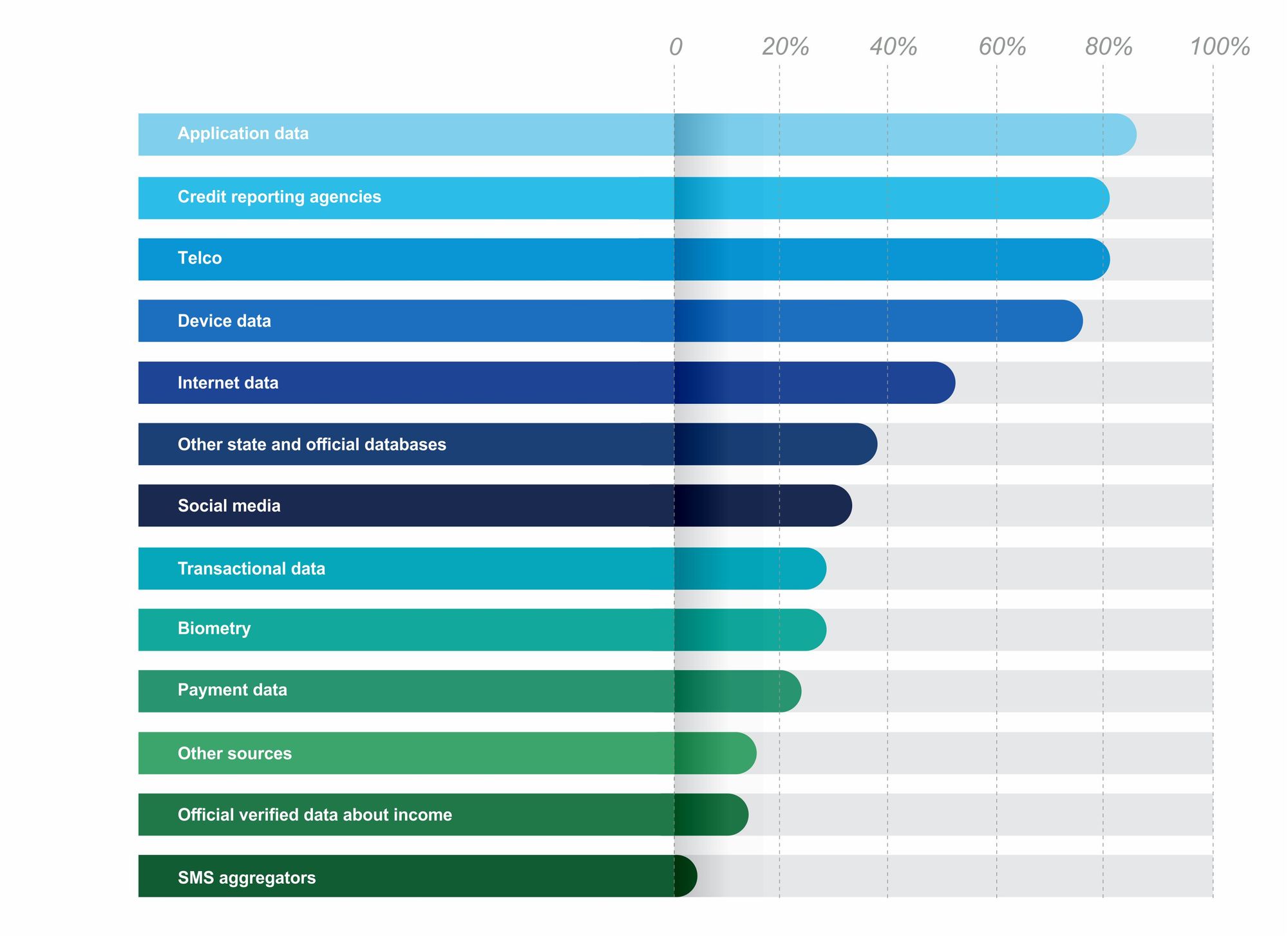

Among the main data sources that can be used by loan organizations for making a decision on new applications approximately 80% of our respondents pointed out 4 main sources: credit application data, credit reporting agencies (or credit bureau), device data and telco data. It seems fair to say that the above mentioned sources are the touchstones for credit organizations of the countries of our presence. Such choice is fully justified by the number of reasons. Any credit process is initiated by a credit application and all the data indicated in such application may be regarded as a starting point of any decision-making system: application data assessment (mostly identification or socio-demographic data) determine the degree of reliability of information and, as a result, the level of financial institute credibility towards an applicant. Credit reporting agencies data directly affects the probability of loan approval or and defines loan parameters, as such data describes most relevant applicant's behaviour pattern and level of responsibility, as well as intend to fulfil financial liabilities. Along with that credit reporting agencies are used to check the validity of initial identification data or, often, contact data. Telco data is the important supplement to the first two categories, which usually describe behavioural or lifestyle component of an applicant, may be used to estimate the probability of fraud risk or disposable income level. Device data allow getting additional information value via alternative view on the applicant through the non-personal data analysis and to complete borrower's portrait especially in this cases, when classic direct identifiers based data sources are lacking some information. Combination of all data categories allows getting holistic applicant view and to make the efficient decision on financial product and its parameters.

Despite the availability of credit reporting agencies data in some Asian countries, the results of our survey showed that there is a great lack of strong data institutions or quality of the data provided by them is rather low. Meanwhile our data is in the first or second place in decision-making system in these countries, which led us to a conclusion that our data is even more valuable for our clients than we could ever thought. Data services scalability as well as high hit rate are becoming the key factors for all the marketeers.

As you can see on this graph, device data is behind free application data as well as credit reporting agencies and telco. Therefore data provided by JuicyScore may be classified as one of the most demanded and frequently used in decision-making systems of online business and intensely influence on quality of decision-making process, overall risk level and portfolio profitability.

Despite the availability of high-quality data of credit reporting agencies in Russia and some other countries as well as the the other sources, JuicyScore rank second to none in decision-making systems in more than 35% of cases (needless to mention free sources such as application score, internal credit history, negative lists, etc.) In 65% of cases JuicyScore data is ranked in top 3 data sources. Only a few years ago device data were coming off as an optional solution that had partial influence on decision-making system for the main part of players, however, as the time goes by our data have proven its efficiency and usefulness and now it becomes more clear that device data have become one of the main fundamental parts of decision-making systems of loan organizations all over the world.

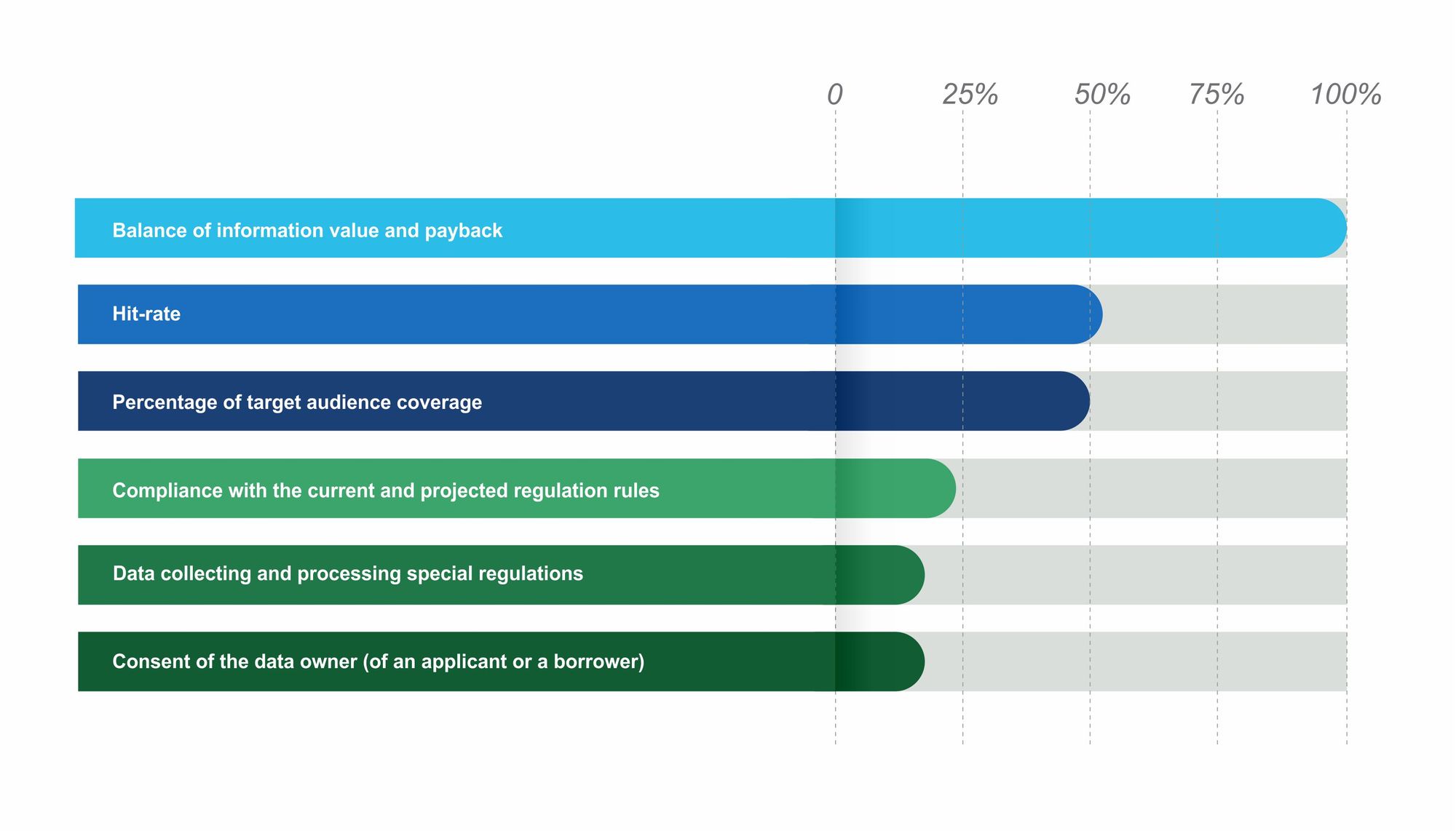

Speaking about the most important parameter for choosing a data source for a decision-making system, which was highlighted by most of our clients, it turned out that the balance of information value and payback takes the center stage and has the highest priority.

It stands to mention that combined with the functionality of our solution we also pay great attention to the balance of information value and data payback and we are really proud of our strong performance. This parameter, to our mind, plays the most important role in efficiency calculations of every component of decision-making system and serves as the reminder of the necessity to observe the information value balance and and data source legitimacy.

Data legal regulation and market long-term outlook

Analyzing the results of our survey we noticed that our respondents do not consider compliance with current and prospective regulating rules as a top-3 criteria. However, basing on the trends we have witnessed over the last 3 years, we can confirm that the above mentioned factor may play crucial role considering selection of data source. Vice versa the source which is compliant to all the data regulations may be the eligibility criteria required for further successful cooperation with official financial institutions. Herewith by regulation we imply not only compliance with the current regulation, but also with the rules set by Central Banks in different countries and any other regulators, browsers’ security policies etc.

Moreover, many companies leading online-business have already been affected by some difficulties related to inconsistency with law regulations (or being not entirely compliant to them). This refers to the categories of collected and processed data regulated by law, including financial transactions data, calendar data, correspondence data, medical history, passport and other documents details, email, address, education and work information etc.For example, if a mobile application does not inform a user about the categories of data collected, the application may be removed or suspended by the marketplace operator (for example, by Google). All these circumstances may pose reputational or financial risks to any company, particularly in case if a high percentage of applications comes through a mobile app. Sometimes companies have to deal with more complicated cases when they collect and process some kinds of data which relate to sensitive or private categories or if collected data processing is prohibited or limited by the law. Such categories of data may be highly informative, however the price is even higher - a revocation of license and regulator's permit to run a business on the territory of the country.

Among the underlying trends which, in our view, are gaining steam may be noted the expansion of the list of data regulated under the country legislation system, expansion of the list of personal and private data, trend to online user privacy increase as well as the settings of operating systems and browsers recent and upcoming versions, closer attention to mobile apps of financial institutions and data content, which are processed within these mobile apps and some other.

While developing of functionality and technologies of our solution we are compliant to all the strict regulation requirements in all the countries of our presence in order to provide stability of decision-making systems of our clients.

As for the development of our solution we deliberately stay away from the data that may be viewed as direct identifiers or may be considered to be a part of a bank secrecy or related to the privacy of correspondence.

In early November this year we stopped using document.cookie for it is not compliant anymore to the security policies of browsers (Chrome, Safari and some others). We replaced it with method of event subscription. Moreover, all our products are compliant not only to the current regulation rules, but also to some of expected changes in the legislation of Russia and a number of other countries.

We express our gratitude to those partners who took part in our survey and also mentioned growth area which they consider to be important in the future. Our clients pointed out the following promising areas:

- Developing of new technologies of fraud risk markers and high risk markers detection

- Increasing of data information value

- Score models customisation by products types and geographies

Among the most valuable features of our products our clients emphasized reasonable data speed and data payback, quality of the data presented, high speed response, high quality of our support service and ease of integration of our solutions.

We are encouraged to strengthen the quality of our solutions, keeping the balance of information value and being compliant with all the data collection and processing requirements.